Trader group identifying subsequent actions to take

It really is time to force all all those coronavirus-era “fundamentals” out of our heads. The inventory industry has currently embraced all those – absent overboard, in point. So, to outperform from listed here, we need to have to ponder two new tendencies in the earning:

Disclosure: Creator is invested 100% in income reserves

The to start with development is a change away from the driving perception that web-anything at all is a surefire winner. That rationale is worn out, building August’s significant winners out of the blue glance top weighty on September 1. As a end result, they are stumbling, hoping to discover their footing. Nonetheless, in this kind of situations, Wall Road moves on, and so need to we.

So, what comes subsequent?

The second pattern is a change to “blended” corporations. These are the companies that make great business enterprise use of the online, and also have other avenues for creating sales. Why is this an approaching pattern? Mainly because it offers 3 attractive attributes:

- It contains the internet utilization with out the bubble angle

- It contains prosperous companies, therefore removing the hazard of beginner flops

- It contains audio fundamentals – not hopes and dreams

At its heart, this new pattern will be the recognition of and need for companies that go over all the bases, have a verified history and possess smart management and enough methods.

Two illustrations popped up today (underlining is mine):

1st, Target’s

Economic Moments (September 25) – “Goal ideas to double staffing for contactless delivery this holiday getaway season“

“‘We’re developing even more overall flexibility into our seasonal staffing as we enter into, what is confident to be, an unparalleled holiday break browsing period,’ Main Government Officer Brian Cornell instructed reporters on a briefing call, adding that it would provide added several hours of perform, starting off with existing workers.

“All through the 1st 50 percent of the year, extra than 10 million new prospects shopped on Target’s web page and demand from customers for very same-working day fulfillment possibilities quadrupled, the retailer said, foremost it to practice additional personnel in places that are in demand from customers these as ‘drive up and order pickup.’

“Distribution centers will ship extra stock to shops than usual to make sure in-demand from customers goods are properly stocked, and to ensure smooth operation the enterprise said it would retain the services of much more entire-time and seasonal warehouse team customers across the nation than previous yr.

“Focus on explained it would fork out its seasonal employees a starting off wage of $15 for every hour along with coronavirus wellness and wellness positive aspects. Team at the entrance of its merchants will aim on basic safety and cleaning, and greeting buyers.”

For comparison, think about Amazon

Second, CarMax’s

From the “Heard on the Avenue” page in The Wall Avenue Journal (September 25): “CarMax Only Looks Like a Lemon – The applied-car or truck retailer is clearly hyper-knowledgeable of budding online opponents these kinds of as Carvana so are its investors”

“… the market’s reaction [to CarMax’s earnings report] went into overdrive: CarMax’s shares dropped extra than 13% following the earnings connect with Thursday morning despite better-than-predicted benefits. Carvana shares had jumped by as considerably as 34.4% on Tuesday after it declared that it expects to crack even on earnings before fascination, taxes, depreciation and amortization in the equivalent quarter, which analysts have extrapolated to signify calendar year-more than-12 months profits advancement of 40%.

“Equally reactions appear to be overdone. As extraordinary as Carvana’s projected progress seems to be, it began out from a much smaller income base. Its third-quarter profits, according to latest estimates, even now would be fewer than 30% of CarMax’s.

“The comparison with the e-commerce business isn’t lost on CarMax, which has rolled out curbside-pickup options to all of its merchants previous quarter and household shipping and delivery to a greater part of its clients, six months to a yr forward of its authentic agenda. Although most shoppers just take some portion of the obtaining method on line, most however like to finalize the deal in the retailer and about 30% do every thing in store, in accordance to CarMax.“

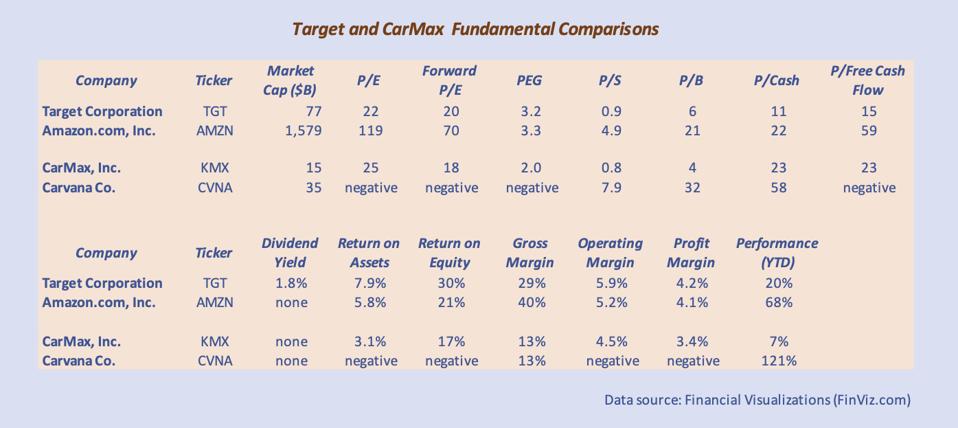

A final point – Elementary comparisons search very good

In addition to the attractiveness of a multi-channel purchaser method, looking at the basic comparisons makes companies like Target and CarMax search like “GARP” stocks (expansion at the correct selling price).

Comparisons: Concentrate on vs Amazon and CarMax vs Carvana

So, invest in now?

Great problem. These number comparisons make the reply, “of course,” seem appropriate. However, that is leapfrogging the weak point in the inventory market now. As much as ETF-targeted financial commitment advisers would like to consider it, an recognized, preferred craze won’t just shift into an additional. There commonly is a shakeout of the favored stocks that creates bearishness, which impacts all stocks. From that turmoil emerges the up coming pattern.

More Stories

What Recent Market Reaction Means for Investors

Market Reaction Explained in Simple Terms

What Drives Sudden Market Reaction