The conclude of Boris Johnson’s operate as key minister could relieve the feeling of political chaos, but it will not fix the deep economic troubles plaguing the British isles economic system.

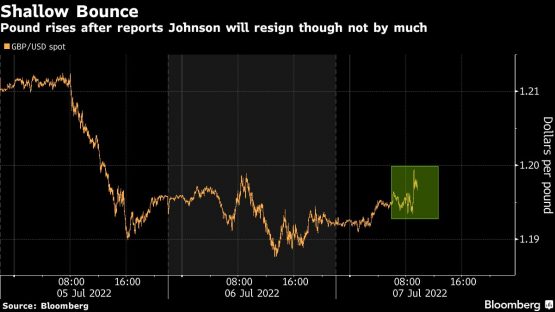

That is the perspective from buyers and sector strategists, who reported they’re however bearish on British property following news broke that Johnson is scheduling to phase down. The quick market reaction was constructive, with the pound climbing back above $1.20. The FTSE 100 Index obtained together with other world-wide inventory indexes.

But traders place little faith in the rally. Sterling is now down 11% this yr and is progressively at the mercy of world risk sentiment. Investors are much more preoccupied with the path of policy at the Bank of England, relatively than whoever resides in Downing Road. And even then, Governor Andrew Bailey and his fellow charge setters say they can only do so a lot in the face of supply disruption and soaring electrical power costs.

“I do not think this resignation will have a huge impact on markets,” claimed Micheal Keusch, a fund manager at Bellevue Asset Management. “It definitely provides incremental uncertainty, but in the grand scheme of matters, with all the serious massive uncertainties all-around, I really do not feel this will be transferring the needle significantly.”

It’s a much cry from when the pound swung on Uk political information all through the Brexit negotiations. Even in the early months of Johnson’s expression, the pound rallied when he changed his chancellor.

That was just before the pandemic and Ukraine war engulfed marketplaces. With inflation at its best in 4 decades, who replaces Johnson as Conservative chief is not going to be enough to change the pound’s program on its own.

The BOE is widely anticipated to shift slower than the Federal Reserve in tightening policy since of UK’s feeble financial state. For forex traders, that interest-fee gap can make sterling fewer interesting.

“There is a cacophony of problems on the following Primary Minister’s plate, not least the cost-of-residing disaster triggering voters so considerably economic agony,” reported Susannah Streeter, senior financial commitment and marketplaces analyst at Hargreaves Lansdown.

Here’s what other market place participants experienced to say:

Neil Jones, head of foreign-trade sales to financial institutions at Mizuho:

“It seems that a host of headline purchase indicators bought the pound on the information,” he reported. “But my sense is lengthier-time period participants will keep on to provide sterling. The pound was a sell prior to the political uncertainty and it really should continue on to development lessen.”

Valentin Marinov, head of G10 forex investigation at Credit rating Agricole:

“FX markets will be hoping that any new leader would strive to restore social gathering unity and make it possible for the Tories to govern much more properly at a time when a charge of dwelling crisis casts a prolonged shadow over the financial state,” he reported. “Some customers even more think that any new federal government would be below pressure by Tory MPs to provide ‘tax cuts’ in an try to enhance development.”

Esty Dwek, main financial commitment officer at Flowbank SA:

“UK stocks are inclined to go a lot more with worldwide indices than on pure Uk developments. Sentiment is additional constructive this morning throughout marketplaces, so seeing a shift bigger is not surprising. There is also hope that much more federal government help could occur as Boris Johnson tries to shore up his premiership.”

Fredrik Repton, portfolio manager at Neuberger Berman.

“My functioning assumption was that there was 1-1.5% hazard premium in GBP owing to the political scenario, but the question now is how much of that can be unwound if Johnson is caretaker till Oct,” he stated.

Pooja Kumra, senior European charges strategist at Toronto Dominion Bank:

“Now critical is for the Conservatives to company up their video game to steer clear of early elections. This could occur by means of greater fiscal shelling out and reforms in taxes. We hope flatter curves as BOE is more very likely to hike swiftly in a significant fiscal set up.”

Mathieu Racheter, head of equity tactic at Julius Baer:

“Given the export-oriented nature of the British isles equity index, domestic economic circumstances are not that important, but rather the effect is by means of the currency moves. That reported, I never assume it is obvious nevertheless what impact Bojo’s resignation has on the pound. 1 could argue for bigger political uncertainty in the Uk, but on the other facet Bojo stepping down signifies lessen uncertainty.”

© 2022 Bloomberg