Alena Kravchenko/iStock Editorial via Getty Photographs

Alphabet (NASDAQ:GOOG) has reported sturdy promoting progress numbers in the recent quarter with quarterly earnings of $55 billion and YoY progress of 23% in this small business. Nevertheless, it is also experiencing tricky levels of competition owing to the rise of Amazon (AMZN) in the digital promoting field. Amazon has solitary-handedly broken the duopoly of Google and Fb (FB) in the electronic ad section. This is quite vital for Google for the reason that the company is dependent heavily on the advert revenue and revenue to drive development in other segments like cloud, components, subscription, etcetera.

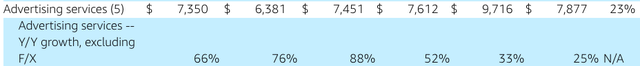

Amazon’s trailing twelve-thirty day period marketing profits has soared earlier mentioned $30 billion and is displaying a sturdy advancement amount. It must be mentioned that Amazon is however rather new to this segment and does not have the innovative advertising and marketing tools which Google offers. We could see even further advancement in Amazon’s marketing small business in the close to phrase, placing force on Google’s expansion. Alphabet inventory is investing at a modest several but new headwinds in the main research company can trigger bearish sentiment towards the stock.

New child on the block

Amazon’s entry into the promoting house has been rather current but the advancement rate demonstrated by the enterprise has allowed it to build a potent income stream. In the final twelve months, the marketing solutions noted about $30 billion in earnings. The margins on this business enterprise are a lot higher when compared to the wafer-skinny margin in the e-commerce section of Amazon. As a result, we could see a lot more emphasis and means specified to the advertising organization by the administration.

Company Filings

Determine 1: Advertising and marketing income of Amazon in the final couple of quarters.

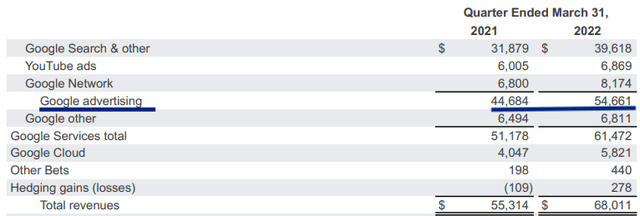

Google will require to have a potent response to the developing domination of Amazon in promoting. The key earnings and revenue contributor for Google is its lookup companies. Any headwind to it would lead to a massive destructive impact on foreseeable future growth of Google and its inventory.

Firm Filings

Figure 2: Bulk of profits from Google arrives from lookup enterprise.

In the most up-to-date quarter, Amazon’s promotion profits was close to 15% of the overall advertising income of Google. Even further investment decision by Amazon in new marketing applications and aid for advertisers can produce a big expansion driver for this section.

Default research selection in retail

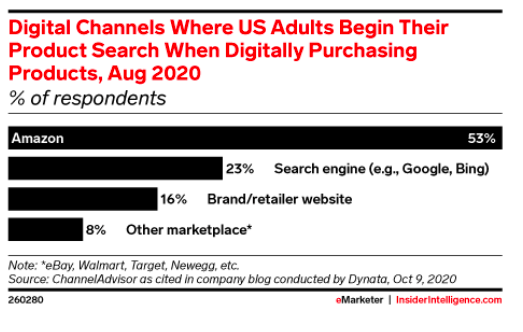

Google also requires to develop an productive system for the switching customer search patterns inside the retail phase. A report by eMarketer shows that Amazon is the default search channel though paying for products and solutions for a substantial the vast majority of clients.

eMarketer

Determine 3: Amazon’s default search standing for consumers making electronic purchases.

This development can enhance in the potential as Amazon enters new item groups. Amazon is now wanting to turn out to be a significant participant in the food stuff shipping industry which will boost the attraction for consumers to immediately research on Amazon.

Google has tried to strengthen its individual Google Browsing platform, but it is not likely that it will be in a position to match Amazon inside the e-commerce place. This is a very long-time period adverse trend for Google which can lead to slower advertising and marketing growth as Amazon raises its possess electronic advert sector share.

An gain and a drawback for Google

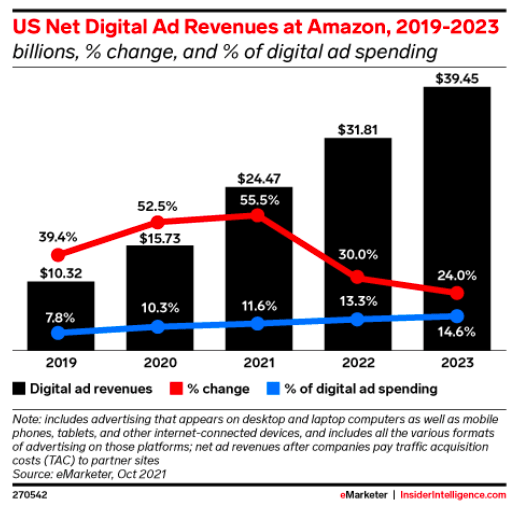

Amazon and Google are now competing in a amount of segments like wise speakers, audio streaming, subscriptions, promotion, and a lot more. Google has utilized its assets and community impact to acquire a large sector share in the search motor sector. Nevertheless, in its fight with Amazon, Google would not have the edge of greater assets. We have already witnessed Amazon devote massively in logistics, video clip streaming, and other organizations to provide expansion. It is probable that Amazon’s administration would be all set to make investments seriously to get a more substantial slice of the digital advertisement field.

eMarketer

Figure 4: Continuous maximize in Amazon’s digital advertisement market place share.

Google has an benefit in terms of its promotion equipment and YouTube system. It continues to devote seriously in AI which ought to give the firm an edge in excess of Amazon. Amazon could also present saturation on its system in phrases of adverts proven to buyers. There has been a slight decrease in Amazon’s YoY advertisement development rate in the recent quarter as opposed to in excess of 50% development throughout the pandemic.

Foreseeable future of Google’s ad business enterprise

The jury is nevertheless out about how substantially current market share can Amazon’s advertising and marketing company choose and the impression it will have on Google’s promoting small business. Investors should really intently adhere to the long term development trajectory of the advert organization inside these two tech giants. At the recent advancement pattern, Google’s marketing earnings ought to hit $100 billion on a quarterly basis by 2025. This is a enormous variety which would give the corporation a better moat in this enterprise. Having said that, Amazon’s expanding electronic ad marketplace share will continue to be a problem for Google’s administration. A major constructive for Google is that it is aggressively trying to diversify its income foundation.

Google is a significant player in sensible speakers and clever property devices. It is also ramping up the Pixel production to achieve a much larger chunk of smartphone sales. Google has noted in excess of 50 million subscribers on its YouTube Quality and Music system. Google Cloud is also attaining momentum and noted $22 billion in annualized earnings level in the latest quarter with a big improvement in working margin.

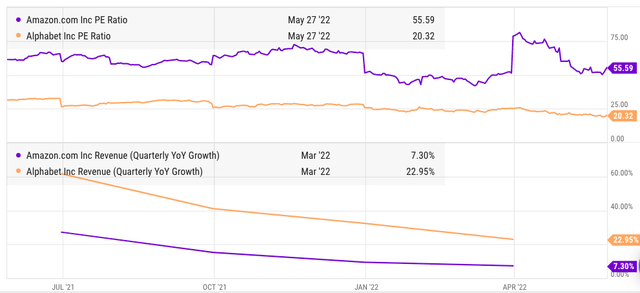

Ycharts

Determine 5: Comparison of YoY revenue advancement and PE ratio of Google and Amazon.

Google is facing rough competitors from Amazon in promoting and a lot of other segments. But the inventory is priced modestly and there is a significant improvement in the extensive-phrase diversification initiatives of the management. If Google can restrict Amazon’s growth in the marketing industry, it will be equipped to shield the main search solutions and also make a for a longer period expansion runway for other providers.

This is the most important challenge that Google’s administration has confronted in more than a ten years. The all round edge is nonetheless with Google but Amazon can definitely toss a several surprises in the marketing area. Buyers really should carefully comply with the growth trajectory in the ad company for these two giants around the subsequent handful of quarters to gauge the returns likely of Alphabet stock.

Trader Takeaway

Google is struggling with a tough obstacle from Amazon in the advertising and marketing segment. In the trailing twelve months, Amazon noted over $30 billion in promoting revenue. The modern quarterly ad profits of Amazon was more than 15% of Google’s look for business. If Amazon carries on to seize a greater current market share in the electronic advert enterprise, it will restrict the development prospective of Google and lessen the capacity of the enterprise to commit in other solutions.

Google is trying to promptly diversify its income foundation by growing financial commitment in cloud, hardware, subscriptions, and other organizations. Nonetheless, it will acquire some time before these bets make a significant chunk of Google’s earnings base. Though Google’s valuation many is even now modest as opposed to other giants, traders should really search at the altering dynamics in the digital advertisement industry to gauge the lengthy-expression growth potential of Alphabet stock.

More Stories

Unlocking the Power of Google Business Tools

Google Business Trends That Will Shape the Future

Boost Sales with These Google Business Tricks