CNBC’s Jim Cramer on Friday stated that a few crucial occasions following 7 days will determine if the nightmarish month for the inventory current market will carry on into Oct.

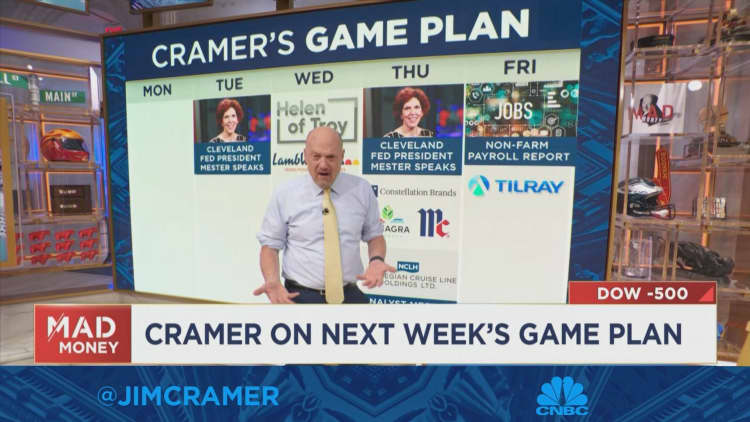

In this article are the situations:

- The launch of the nonfarm labor report Friday. Cramer stated he expects it to exhibit inflated employing and wages.

- Two talking engagements by Cleveland Fed President Loretta Mester, who Cramer thinks is the principal inflation hawk on the Federal Open up Industry Committee. “She wishes to secure us … from substantial inflation, even if that signifies elevating interest rates into a recession,” he reported.

The S&P 500 shut out its worst thirty day period considering that March 2020 on Friday. The Dow Jones Industrial Average and the Nasdaq Composite fell 8.8% and 10.5%, respectively, for the month.

Whilst it truly is very likely that Mester and the report will equally deliver bad news, buyers can guard on their own from the current market wreckage if they stick to a reliable match program, in accordance to Cramer.

“Personal higher-high-quality organizations with excellent equilibrium sheets and superior dividends that will advantage from a drop in inflation, mainly because that is what is actually going to materialize,” he reported.

He also previewed following week’s slate of earnings. All earnings and earnings estimates are courtesy of FactSet.

Wednesday: Helen of Troy, Lamb Wesson

Helen of Troy

- Q2 2023 earnings release right before the bell conference connect with at 9 a.m. ET

- Projected EPS: $2.21

- Projected profits: $521 million

Lamb Weston Holdings

- Q1 2023 earnings launch at 8:30 a.m. ET convention contact at 10 a.m. ET

- Projected EPS: 79 cents

- Projected revenue: $1.21 billion

“We saw this from Nike past night — all that transpires is the draw back will get accentuated as the upside just treads h2o or goes marginally bigger. That’s what I assume will happen with the two when they report,” Cramer reported.

Thursday: Constellation Brands, Conagra Makes, McCormick, Norwegian Cruise Line Holdings

Constellation Manufacturers

- Q2 2023 earnings launch at 7:30 a.m. ET meeting simply call at 10:30 a.m. ET

- Projected EPS: $2.81

- Projected income: $2.51 billion

He reported he expects the firm’s prime line to be “extraordinarily very good.”

Conagra Brand names

- Q1 2023 earnings launch at 7:30 a.m. ET conference connect with at 9:30 a.m. ET

- Projected EPS: 52 cents

- Projected revenue: $2.85 billion

The business wants to develop its company, according to Cramer.

McCormick

- Q3 2022 earnings launch at 6:30 a.m. ET conference call at 8 a.m. ET

- Projected EPS: 71 cents

- Projected earnings: $1.6 billion

Cramer claimed that the company’s earnings call will basically boost its preannounced weaker-than-expected third-quarter earnings and total-year outlook cut before this thirty day period.

Norwegian Cruise Line

- Investor meeting at 10 a.m. ET

Cramer explained that he expects Norwegian to be doing superior than competitor Carnival, which struggled with better expenses in its newest quarter, but it is really unclear irrespective of whether that will be more than enough to aid Norwegian’s inventory.

Friday: Tilray Manufacturers

- Q1 2023 earnings release at 7 a.m. ET convention simply call at 8:30 a.m. ET

- Projected reduction: reduction of 5 cents for every share

- Projected income: $169 million

He predicted that the enterprise will make a “bold” assertion about the legalization of hashish and said he is pondering regardless of whether this could be a good speculative stock to possess during the Biden administration.

Disclosure: Cramer’s Charitable Belief owns shares of Constellation Manufacturers.